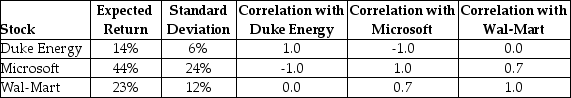

Consider the following expected returns, volatilities, and correlations:

The volatility of a portfolio that is equally invested in Wal-Mart and Duke Energy is closest to ________.

Definitions:

Behavioural Approach

A psychological perspective focusing on observable behaviors, emphasizing the role of learning and environment in shaping behavior.

Strengths

The qualities or attributes that are considered to be positive and beneficial, contributing to effectiveness and success.

Weaknesses

Characteristics or areas that lack strength or ability, often leading to vulnerability or ineffective performance.

Humanistic Theorists

Psychologists who emphasize an individual's inherent drive towards self-actualization and creativity.

Q3: An analysis that breaks the net present

Q8: Even if two firms operate in the

Q29: What is yield to maturity?

Q30: A bond has a face value of

Q30: The above screen shot from Google Finance

Q62: Which of the following decision rules is

Q76: Which of the following statements is FALSE?<br>A)

Q80: Moon Company plans to issue 10 million

Q99: SIROM Scientific Solutions has $12 million of

Q100: Assume that in addition to 1.25 billion