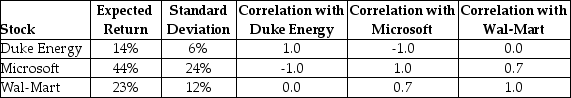

Consider the following expected returns, volatilities, and correlations:

The volatility of a portfolio that is equally invested in Wal-Mart and Duke Energy is closest to ________.

Definitions:

Fire or Flood Loss

Refers to the financial impact on a business or individual's assets due to damage caused by fire or floods, often covered by insurance.

Litigation Settlement

The resolution of a legal dispute before the court issues a final verdict, often involving payment to the aggrieved party.

Related-Party Transactions

Transactions occurring between parties where one is able to exert significant influence over the operations of the other, such as between a parent company and its subsidiary.

Affiliated Entities

Affiliated entities are companies that are related through common ownership or control, potentially impacting financial statements and disclosures.

Q24: Consider the following average annual returns:<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5536/.jpg"

Q28: Gonzales Corporation generated free cash flow of

Q60: The relative proportions of debt, equity, and

Q62: If returns on stock A are more

Q65: What is the assumption about risk when

Q68: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5536/.jpg" alt=" A fast-food company

Q70: In a setting where there is no

Q81: Assume that MM's perfect capital markets conditions

Q91: As we add more uncorrelated stocks to

Q102: Which of the following statements is FALSE?<br>A)