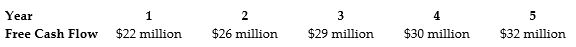

General Industries is expected to generate the above free cash flows over the next five years, after which free cash flows are expected to grow at a rate of 5% per year. If the weighted average cost of capital is 9% and General Industries has cash of $15 million, debt of $45 million, and 80 million shares outstanding, what is General Industries' expected current share price?

General Industries is expected to generate the above free cash flows over the next five years, after which free cash flows are expected to grow at a rate of 5% per year. If the weighted average cost of capital is 9% and General Industries has cash of $15 million, debt of $45 million, and 80 million shares outstanding, what is General Industries' expected current share price?

Definitions:

KPI Tracker

A KPI tracker is a tool or system used for monitoring and analyzing Key Performance Indicators (KPIs) to assess efficiency, effectiveness, and performance in various business areas.

Opportunity Cost

The cost of an alternative that must be forgone in order to pursue a certain action, essentially what is given up when choosing one option over another.

Key Performance Indicator

A quantifiable metric that shows how successfully a business is meeting its primary goals.

Q1: What is the internal rate of return

Q3: Is it possible for a stock to

Q11: Which of the following statements is FALSE?<br>A)

Q18: The above screen shot from Google Finance

Q47: Avril Synchronistics will pay a dividend of

Q47: An all-equity firm had a dividend expense

Q56: The price of Microsoft is $37 per

Q71: A firm's cost of debt is the

Q73: Consider the following two projects:<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5536/.jpg" alt="Consider

Q94: If your new strip mall will have