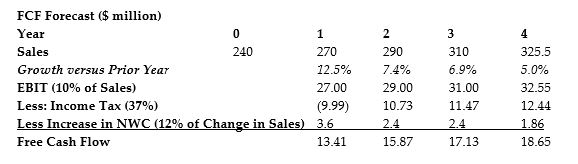

Use the table for the question(s) below.

Banco Industries expect sales to grow at a rapid rate over the next three years, but settle to an industry growth rate of 5% in year 4. The spreadsheet above shows a simplified pro forma for Banco Industries. If Banco industries has a weighted average cost of capital of 11%, $50 million in cash, $80 million in debt, and 18 million shares outstanding, which of the following is the best estimate of Banco's stock price at the start of year 1?

Definitions:

Cash Flows

The inflows and outflows of cash and cash equivalents, representing the operating, investing, and financing activities of an entity.

Net Present Value

The difference between the present value of an investment project’s cash inflows and the present value of its cash outflows.

Internal Rate

Internal Rate, often referred to as Internal Rate of Return (IRR), is the rate of growth a project is expected to generate, used in capital budgeting to estimate the profitability of potential investments.

Cash Flows

The movement of money into and out of a business or project, considered vital for assessing the financial health of an entity.

Q11: Which of the following statements is FALSE?<br>A)

Q14: What is the relationship between the growth

Q23: Convertible bonds have a provision that gives

Q27: Which of the following statements is FALSE?<br>A)

Q39: Peter has a business opportunity that requires

Q45: A portfolio has 45% of its value

Q47: Which of the following statements concerning the

Q51: Suppose you invest in 220 shares of

Q96: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5536/.jpg" alt=" An investor has

Q103: Suppose you invest in 100 shares of