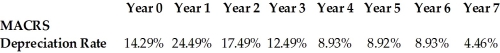

A textile company invests $10 million in an open-end spinning machine. This was depreciated using the seven-year MACRS schedule shown above. If the company sold it immediately after the end of year 3 for $7 million, what would be the after-tax cash flow from the sale of this asset, given a tax rate of 40%?

A textile company invests $10 million in an open-end spinning machine. This was depreciated using the seven-year MACRS schedule shown above. If the company sold it immediately after the end of year 3 for $7 million, what would be the after-tax cash flow from the sale of this asset, given a tax rate of 40%?

Definitions:

Authorization Cards

Documents signed by employees to indicate their wish to be represented by a labor union.

Organized Labor

A group of workers united as a single, representative entity for the purpose of improving the workers' economic status and working conditions through collective bargaining with employers.

Contingent Workers

Individuals who are employed in temporary or freelance positions, rather than holding permanent employment.

Decertification

The process by which a union is removed as the representative of a group of workers in collective bargaining or labor negotiations.

Q18: If you want to value a firm

Q19: When corporate tax rates decline, the net

Q19: What is the general shape of the

Q54: A stock is expected to pay $0.70

Q66: The effective annual rate (EAR) for a

Q80: The WACC does not depend on the

Q80: Moon Company plans to issue 10 million

Q83: The table above shows the rate of

Q109: Which of the following accounts has the

Q110: How does IPO pricing puzzle financial economists?