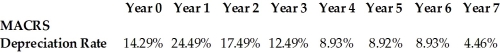

Massive Amusements, an owner of theme parks, invests $65 million to build a roller coaster. This can be depreciated using the MACRS schedule shown above. How much less is the depreciation tax shield for year 4 under MACRS depreciation than under 7-year, straight-line depreciation, if the tax rate is 35%?

Massive Amusements, an owner of theme parks, invests $65 million to build a roller coaster. This can be depreciated using the MACRS schedule shown above. How much less is the depreciation tax shield for year 4 under MACRS depreciation than under 7-year, straight-line depreciation, if the tax rate is 35%?

Definitions:

Balance Sheet

A statement that illustrates a corporation's liabilities, assets, and shareholders' capital at a specified point in time.

Other Assets

Assets not fitting into the standard categories like current or fixed assets, often including long-term investments, patents, or deposits.

Assets Sold

Items of value or resources owned by a company that have been disposed of or sold to another party.

Deficit

Amount by which net income falls short of salary and interest allowance. Also an abnormal, or debit, balance in a partner’s capital account.

Q22: When a firm is evaluating the purchase

Q25: A perpetuity has a PV of $20,000.

Q29: Which of the following statements is FALSE?<br>A)

Q35: Assume Ford Motor Company is discussing new

Q40: What is the diversification achieved by an

Q40: Consider the following two projects:<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5536/.jpg" alt="Consider

Q53: You expect KT industries (KTI) will have

Q53: A homeowner has five years of monthly

Q65: A security company offers to provide CCTV

Q95: A pottery factory purchases a continuous belt