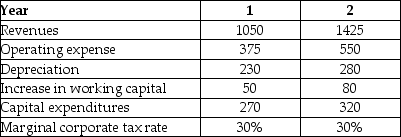

Shepard Industries is evaluating a proposal to expand its current distribution facilities. Management has projected the project will produce the following cash flows for the first two years (in millions) .

The depreciation tax shield for Shepard Industries project in year 1 is closest to ________.

Definitions:

Option's Intrinsic Value

The difference between the current price of the underlying asset and the strike price of an option, assuming the option is in-the-money.

Strike Value

The predetermined price at which the holder of an option can buy (call option) or sell (put option) the underlying asset.

Market Value

The present cost at which a service or asset is available for purchase or sale in a free market.

Volatility Value

A statistical measure of the dispersion of returns for a given security or market index, often used to quantify risk.

Q2: Ford Motor Company is considering launching a

Q4: A portfolio of stocks can achieve diversification

Q14: Suppose you invest $15,000 by purchasing 200

Q14: A levered firm is one that has

Q35: Rational investors _ fluctuations in the value

Q47: Avril Synchronistics will pay a dividend of

Q51: Which of the following bonds will be

Q53: Why do we use leverage if it

Q78: Temporary Housing Services Incorporated (THSI) is considering

Q104: What is the implied assumption about interest