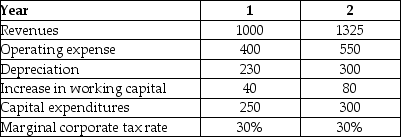

Shepard Industries is evaluating a proposal to expand its current distribution facilities. Management has projected that the project will produce the following cash flows for the first two years (in millions of dollars) .

The depreciation tax shield for Shepard Industries project in year 2 is closest to ________.

Definitions:

Balance Sheet Approach

A method in accounting that focuses on valuing all assets and liabilities listed on the balance sheet at their current market values to provide a snapshot of a company's financial condition at a specific point in time.

Direct Write-off Approach

An accounting method for dealing with bad debts where specific accounts receivable are written off against income at the time they are determined to be uncollectible.

Normal Balance

The side of an account that is increased, which for assets, expenses, and dividends is the debit side, and for liabilities, equity, and revenue is the credit side.

Financial Statement

A documented account detailing the commercial operations and fiscal outcomes of an enterprise.

Q52: An annuity pays $10 per year for

Q58: Which of the following formulas is INCORRECT?<br>A)

Q76: Many financial managers use market risk premiums

Q77: Parafoil Avionics sells 50 million shares of

Q79: What rating must Luther receive on these

Q82: When there are large numbers of people

Q87: Mary is in contract negotiations with a

Q92: Your estimate of the market risk premium

Q102: Firms should use the most accelerated depreciation

Q103: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5536/.jpg" alt=" Harrison Products is