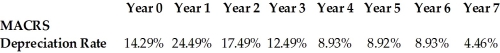

A textile company invests $10 million in an open-end spinning machine. This was depreciated using the seven-year MACRS schedule shown above. If the company sold it immediately after the end of year 3 for $7 million, what would be the after-tax cash flow from the sale of this asset, given a tax rate of 40%?

A textile company invests $10 million in an open-end spinning machine. This was depreciated using the seven-year MACRS schedule shown above. If the company sold it immediately after the end of year 3 for $7 million, what would be the after-tax cash flow from the sale of this asset, given a tax rate of 40%?

Definitions:

Compound Journal Entry

An accounting entry that involves more than two accounts, where there are multiple debits, multiple credits, or both.

Salvage Value

The appraisal of an asset’s market price at the exhaustion of its operational time.

Depreciation Rates

The percentage at which an asset's value is reduced to account for wear and tear over its useful life.

Units-of-activity Method

A depreciation method that allocates the cost of an asset over its useful life based on units of production or use, rather than passage of time.

Q7: In 2009, U.S. Treasury yielded 0.1%, while

Q22: The cash flows for four investments have

Q25: Assuming that your capital is constrained, which

Q54: Internal financing is more costly than external

Q55: Rylan Industries is expected to pay a

Q59: Consider the following timeline detailing a stream

Q84: Tanner is choosing between two investment options.

Q108: When different investment rules give conflicting answers,

Q109: An equity issue that raises new funds

Q109: An insurance office owns a large building