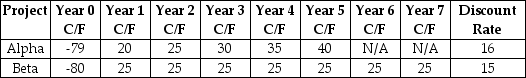

Consider the following two projects:

Assume that projects Alpha and Beta are mutually exclusive. The correct investment decision and the best rationale for that decision is to ________.

Definitions:

Vertical Analysis

A method of financial statement analysis in which each entry for each of the three major categories of accounts (or financial statements) is represented as a proportion of the total account.

Common-Size Financial Statement

A financial analysis tool that presents all line items as a percentage of a common base figure, making it easier to compare financial statements of different-sized companies.

Vertical Analysis

A method of financial statement analysis in which each entry for a given period is represented as a proportion of a chosen total.

Operating Cycle

The amount of time it takes for a company to purchase inventory, sell it, and convert the sale back into cash.

Q21: Since total risk is greater than systematic

Q22: The cash flows for four investments have

Q36: Consider an economy with two types of

Q37: In the method of comparables, the known

Q41: Greg purchased stock in Bear Stearns and

Q59: Which of the following best shows the

Q67: What are the two components of realized

Q68: The current zero-coupon yield curve for risk-free

Q107: Dollar amounts received at different points in

Q111: The cash flow effect from a change