Use the information for the question(s) below.

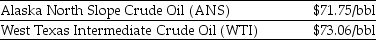

As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.

Another oil refiner is offering to trade you 10,150 bbl of Alaska North Slope (ANS) crude oil for 10,000 bbl of West Texas Intermediate (WTI) crude oil. Assuming you currently have 10,000 bbl of WTI crude, what should you do?

Definitions:

Perpetual Inventory System

A perpetual inventory system is a method of tracking inventory in real-time, with continuous updates to inventory records as sales and purchases occur.

Gross Method

An accounting practice where discounts for prompt payment are recorded as reductions of expense if taken.

General Journal Entries

Records of financial transactions not assigned to specific accounts in the general ledger, but recorded in a general journal.

Gross Margin

The difference between revenue and cost of goods sold divided by revenue, expressed as a percentage, indicating the financial health and efficiency of a product or business.

Q2: GenCorp. has a total debt of $140

Q17: Which of the following best describes why

Q19: What is a major assumption about growth

Q29: Chittenden Enterprises has 643 million shares outstanding.

Q37: If $432 invested today yields $450 in

Q63: What is the most common type of

Q72: In which of the following relationships is

Q83: Prior to its maturity date, the price

Q86: Consider the following prices from a McDonald's

Q112: A lottery winner can take $6 million