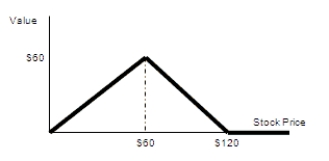

Combining options: Suppose you are creating a portfolio that consists of zero-interest bonds, stock from a single company, and call and put options on the stock. Holding which of the following combination of securities will give the payoff shown in the following diagram?

Definitions:

DRM

Digital Rights Management, technology used to control the use of digital content and devices after sale.

Access Control

Access control is a security technique that regulates who or what can view or use resources in a computing environment, encompassing authorization, authentication, and audit.

Copyright

A creator’s exclusive rights to use a work of intellectual property, such as making copies of it or selling it.

Intellectual Property

Legal rights given to individuals or companies over creations of the mind, such as inventions, literary and artistic works.

Q30: Tactics that venture capitalists use to reduce

Q33: Country risk should be incorporated into the

Q51: Minimizing the cost of a firm's financing

Q56: Which one of the following statements is

Q58: Holding the growth rate constant, the higher

Q58: How stock repurchases differ from dividends: ABC

Q60: Financial statements and sales forecasts are considered

Q73: The optimal capital structure of a firm<br>A)

Q76: A factor is an individual or financial

Q85: The sales forecasts used in financial planning<br>A)