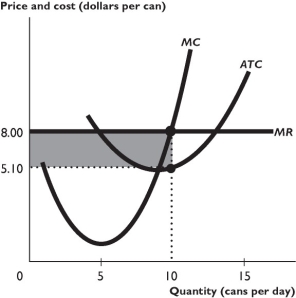

The figure above shows some of a firm's cost curves and its marginal revenue curve.

-Suppose the price of a can was $5.10.In this case,to maximize its profit,the firm illustrated in the figure above would

Definitions:

Deferred Tax Liability

A tax obligation that arises when taxable income is delayed or postponed to future periods, reflecting taxes that are expected to be paid in the future.

Accrual Method

An accounting method that records revenues and expenses when they are earned or incurred, regardless of when the cash is received or paid.

Installment Sales Method

The installment sales method is an accounting technique used to recognize revenue and income on sales made through installment payments over time.

Intraperiod Tax Allocation

The process of allocating income taxes within a single financial reporting period, dividing the total tax expense among different parts of the financial statements.

Q22: A market is classified as an oligopoly

Q31: Use the figure above to answer this

Q45: For a regulated natural monopoly,the marginal cost

Q57: The total product is 10 units.The average

Q70: The above figure illustrates the market for

Q106: Jeremiah runs a bullfrog farm in Frogville,Oklahoma.Jeremiah

Q157: Which of the following curves are U-shaped?<br>I.average

Q210: If new firms enter a perfectly competitive

Q232: Jennifer owns a pig farm near Salina,Kansas.Last

Q246: Legally established titles to the ownership,use,and disposal