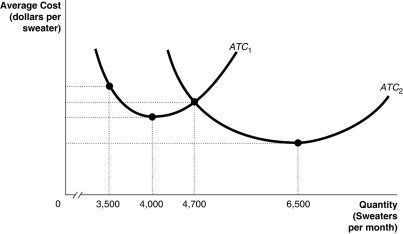

Suppose Argyle Sachs has to choose between building a smaller sweater factory and a larger sweater factory.In the following graph,the relationship between costs and output for the smaller factory is represented by the curve ATC1,and the relationship between costs and output for the larger factory is represented by the curve ATC2.  a.If Argyle expects to produce 3,600 sweaters per month,should he build a smaller factory or a larger factory? Briefly explain?

a.If Argyle expects to produce 3,600 sweaters per month,should he build a smaller factory or a larger factory? Briefly explain?

b.If Argyle expects to produce 5,000 sweaters per month,should he build a smaller factory or a larger factory? Briefly explain.

c.If the average cost of producing sweaters is lower in the larger factory when Argyle produces 6,500 sweaters per week,why isn't it also lower when Argyle produces 4,000 sweaters per week?

Definitions:

Market Price

Market price is the current price at which a security or commodity can be bought or sold in a public market.

Security

A financial instrument representing an ownership position in a publicly-traded corporation (stock), a creditor relationship with a governmental body or a corporation (bond), or rights to ownership as represented by an option.

Direct Private Long-term Debt Financing

A funding method where businesses borrow money directly from private investors, bypassing traditional bank loans, usually for a period longer than one year.

Public Issues

The offering of securities by a company to the public in order to raise capital.

Q10: Max Shreck,an accountant,quit his $80,000-a-year job and

Q11: Stockholders<br>A)select the board of directors of a

Q21: The short run is the time period

Q38: If a firm's fixed cost exceeds its

Q64: Which of the following is a characteristic

Q83: Many airlines have not reduced or eliminated

Q88: Suppose the absolute value of the price

Q110: Refer to Table 8-2.Alicia Gregory owns a

Q134: The minimum point on the average variable

Q149: Psychologists Daniel Kahneman and Amos Tversky conducted