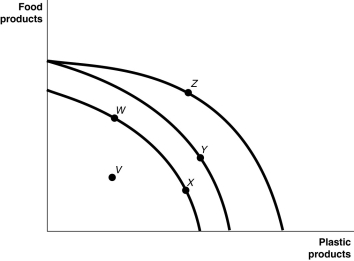

Figure 2-4  Figure 2-4 shows various points on three different production possibilities frontiers for a nation.

Figure 2-4 shows various points on three different production possibilities frontiers for a nation.

-Refer to Figure 2-4. A movement from Y to Z

Definitions:

Put Option

A financial contract that gives the owner the right, but not the obligation, to sell a specified amount of an underlying asset at a specified price within a specified time.

Sell Calls

An investment strategy involving the selling of call options, where the seller grants the buyer the right to purchase an underlying asset at a specified price within a certain period.

Buy Warrants

Options that give the holder the right to purchase a company's stock at a specified price before a certain date.

Employee Stock Option

A privilege, sold by one party to another, that gives the buyer the right, but not the obligation, to buy (call) or sell (put) a stock at an agreed-upon price within a certain period or on a specific date.

Q2: A situation in which a country does

Q40: Refer to Figure 3-5.At a price of

Q44: Suppose a large firm allows its employees

Q45: Of the following,which has most likely contributed

Q45: From a supply perspective,what impact would an

Q47: If,in response to an increase in the

Q50: Refer to Figure 19-1.Under autarky,the deadweight loss

Q75: In the long run,most economists agree that

Q84: If the number of firms producing mouthwash

Q104: The attainable production points on a production