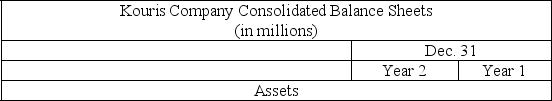

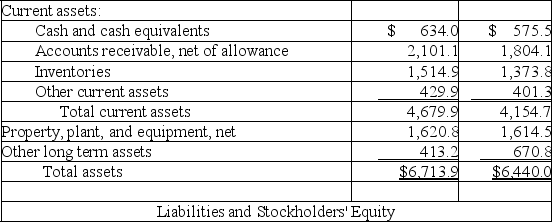

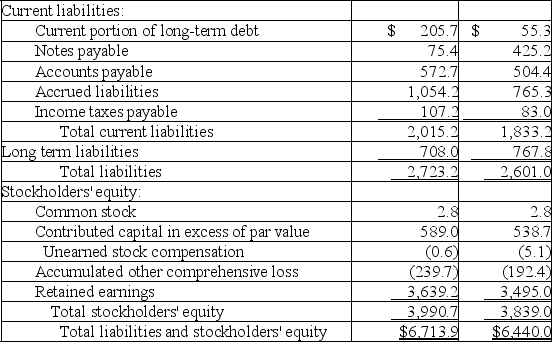

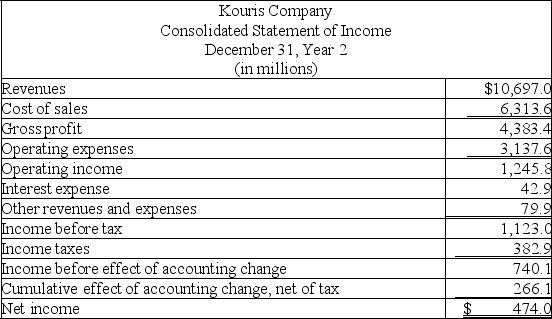

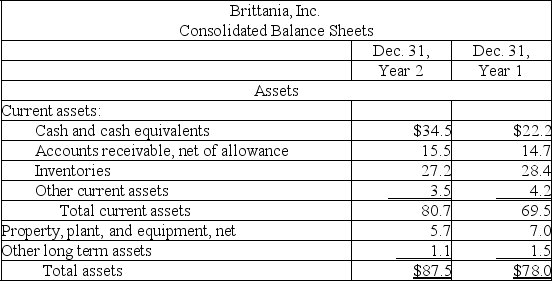

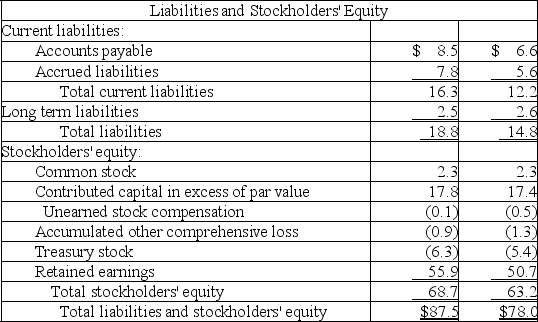

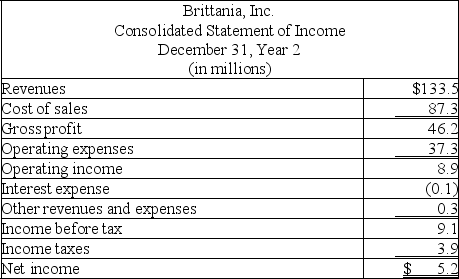

The following summaries from the income statements and balance sheets of Kouris Company and Brittania, Inc. are presented below.

(1) For both companies for Year 2, compute the:

(a) Current ratio

(b) Acid-test ratio

(c) Accounts receivable turnover

(d) Inventory turnover

(e) Days' sales in inventory

(f) Days' sales uncollected

Which company do you consider to be the better short-term credit risk? Explain.

(2) For both companies for Year 2, compute the:

(a) Profit margin ratio

(b) Return on total assets

(c) Return on common stockholders' equity

Which company do you consider to have better profitability ratios?

Definitions:

Lie Flat

A body position where an individual lays down horizontally on a surface with the back facing down and is often advised for various health reasons.

Gait Belt

A safety device used by caregivers to support a person who is unsteady on their feet during walking or transferring.

Patients

Individuals receiving or registered to receive medical treatment.

Ease

The quality of being comfortable, free from difficulty or effort.

Q17: Draw an entity-relationship diagram that describes the

Q26: All of the following are corporate resources,

Q38: A data definition language (DDL) _.<br>A) is

Q39: The term "binary" in binary relationship indicates

Q49: The time value of money concept:<br>A) Means

Q50: Contribution margin lost from a decline in

Q51: All of the following features of a

Q51: In a many-to-many unary relationship an occurrence

Q53: The use of a subquery in an

Q127: Both the direct and indirect methods yield