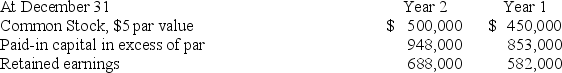

Salah's net income for the year ended December 31, Year 2 was $175,000. Information from Salah's comparative balance sheets is given below. Compute the cash paid for dividends during Year 2.

Definitions:

Head of Household

A tax filing status for individuals who are unmarried and provide home support for a qualifying person.

Federal Tax Withheld

The portion of an employee's paycheck that is taken by the employer and sent directly to the federal government as partial payment of income tax.

Tax Refund

The reimbursement of excess taxes paid by a taxpayer to the government over the course of the tax year.

Adjusted Gross Income

An individual's total gross income minus specific deductions allowed by the IRS, used to calculate taxable income.

Q20: The internal rate of return method of

Q21: A company had average total assets of

Q26: An expense that is readily traced to

Q46: All of the following are examples of

Q51: The decision to accept an additional volume

Q56: Total asset turnover reflects a company's ability

Q63: Based on the information in the following

Q100: JK Company can sell all of the

Q112: Maxim manufactures a hamster food product called

Q235: A corporation reports the following year-end