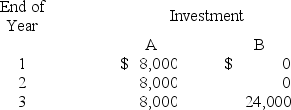

Alfarsi Industries uses the net present value method to make investment decisions and requires a 15% annual return on all investments. The company is considering two different investments. Each require an initial investment of $15,000 and will produce cash flows as follows:  The present value factors of $1 each year at 15% are:

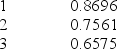

The present value factors of $1 each year at 15% are: The present value of an annuity of $1 for 3 years at 15% is 2.2832

The present value of an annuity of $1 for 3 years at 15% is 2.2832

Which investment should Alfarsi choose?

Definitions:

Competitive Weapon

A unique capability or strategy employed by a company to outperform its competitors.

Barrier To Entry

Elements or circumstances that prevent or hinder the ability of new competitors to enter an industry or market.

Cosmetologists

Professionals who provide beauty treatments, including hair styling, makeup, and skincare services.

Hair Styling

The art or profession of cutting, arranging, or shaping hair to enhance an individual's appearance.

Q23: What is an investment center and how

Q27: When the selling division in an internal

Q47: If Management was not concerned with the

Q64: Cost center managers are evaluated on their

Q65: The _ measures the average time it

Q73: A job was budgeted to require 3

Q200: In preparing Tywin Company's statement of cash

Q207: Use the following information from the current

Q221: Financing activities include receiving cash from issuing

Q229: Cash flows are essentially the same as