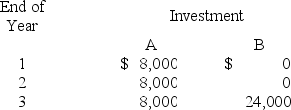

Alfarsi Industries uses the net present value method to make investment decisions and requires a 15% annual return on all investments. The company is considering two different investments. Each require an initial investment of $15,000 and will produce cash flows as follows:  The present value factors of $1 each year at 15% are:

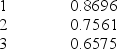

The present value factors of $1 each year at 15% are: The present value of an annuity of $1 for 3 years at 15% is 2.2832.

The present value of an annuity of $1 for 3 years at 15% is 2.2832.

The net present value of Investment A is:

Definitions:

Specific Antigen

A unique molecule or part of a molecule that triggers an immune response, being recognized by specific antibodies.

Immunoglobulin

Any of a class of proteins present in the serum and cells of the immune system, which function as antibodies.

Plasma Membrane

The lipid bilayer membrane surrounding a cell that controls the passage of substances in and out, maintaining the cell's internal environment.

Lysozyme

Antibacterial enzyme in body secretions such as saliva and mucus.

Q10: A department that incurs costs without directly

Q41: A hurdle rate is the minimum acceptable

Q50: Refer to the following selected financial

Q51: The decision to accept an additional volume

Q57: Good management accounting indicates that projects be

Q77: Which of the following is an objective

Q84: A flexible budget performance report compares the

Q91: The total cost method determines a selling

Q136: A company had a market price of

Q143: The most useful allocation basis for the