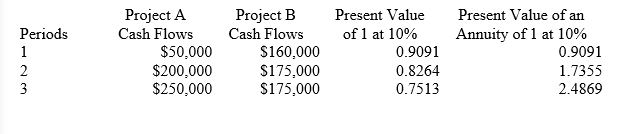

Trevoline Company is deciding between two projects. Each project requires an initial investment of $350,000. The projected net cash flows for the two projects are listed below. The revenue is to be received at the end of each year. Trevoline requires a 10% return on its investments. The present value of an annuity of 1 and present value of an annuity factors for 10% are presented below. Use net present value to determine which project should be pursued and explain why.

Definitions:

Inflammation

Part of innate immunity: a local response to tissue damage or infection; characterized by redness, warmth, swelling, and pain.

Allergies

Immune system reactions to certain foreign substances perceived as harmful.

Healthy Adult

An individual in the mature stage of life exhibiting physical, mental, and social well-being.

Innate Immunity

The first line of defense in the immune system, consisting of physical, chemical, and cellular defenses against pathogens that are present from birth.

Q41: Cornish Company had the following results of

Q69: A company has the choice of either

Q69: How does the calculation of break-even time

Q83: Identify the financial analysis building block most

Q90: A useful measure used to evaluate the

Q99: Investment center managers are evaluated on their

Q135: Incremental costs are also called out-of-pocket costs.

Q159: A department can never be considered to

Q160: When preparing the operating activities section of

Q192: Investment center is another name for profit