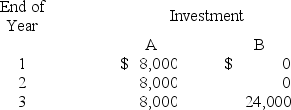

Alfarsi Industries uses the net present value method to make investment decisions and requires a 15% annual return on all investments. The company is considering two different investments. Each require an initial investment of $15,000 and will produce cash flows as follows:  The present value factors of $1 each year at 15% are:

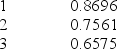

The present value factors of $1 each year at 15% are: The present value of an annuity of $1 for 3 years at 15% is 2.2832

The present value of an annuity of $1 for 3 years at 15% is 2.2832

Which investment should Alfarsi choose?

Definitions:

Microevolution

Change in allele frequency.

Independent Assortment

A basic principle of genetics developed by Mendel stating that genes for different traits are sorted separately from one another so the inheritance of one trait is not dependent on the inheritance of another.

Crossing Over

Process by which homologous chromosomes exchange corresponding segments of DNA during prophase I of meiosis.

Sexual Selection

A mode of natural selection where individuals with certain inherited traits are more likely to find a mate and reproduce, often leading to the evolution of traits that enhance mating success.

Q12: Fallow Corporation has two separate profit centers.

Q22: Summerlin Company budgeted 4,000 pounds of material

Q55: Which of the following is not part

Q96: A company buys a machine for $60,000

Q112: Maxim manufactures a hamster food product called

Q125: A fixed budget performance report never provides

Q146: The standards for comparisons when interpreting measures

Q171: Brownley Company has two service departments and

Q174: Static budget is another name for:<br>A) Standard

Q227: Which one of the following is an