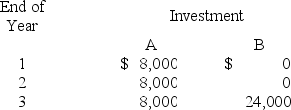

Alfarsi Industries uses the net present value method to make investment decisions and requires a 15% annual return on all investments. The company is considering two different investments. Each require an initial investment of $15,000 and will produce cash flows as follows:  The present value factors of $1 each year at 15% are:

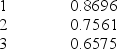

The present value factors of $1 each year at 15% are: The present value of an annuity of $1 for 3 years at 15% is 2.2832.

The present value of an annuity of $1 for 3 years at 15% is 2.2832.

The net present value of Investment A is:

Definitions:

Integrative Negotiation

A negotiation strategy focused on collaborative approaches to achieve mutually beneficial outcomes.

Pre-settlement Settlements

Agreements made before reaching the final settlement in a negotiation, often to resolve some issues in advance and streamline the process.

Nonspecific Compensation

A form of reimbursement or reward not tied to specific criteria or outcomes, often used in contexts to encourage general performance or satisfaction.

Integrative Negotiators

Individuals who aim for solutions that satisfy all parties involved, focusing on mutual gains rather than competing interests.

Q7: The cash flow on total assets ratio:<br>A)

Q22: Ash Company reported sales of $400,000 for

Q23: A company paid cash dividends on its

Q41: A flexible budget is useful both before

Q138: The Mad Hatter Company owns a machine

Q140: In a firm that manufactures clothing, the

Q149: Ready Company has two operating (production) departments:

Q153: The direct method for computing and reporting

Q183: Responsibility accounting performance reports:<br>A) Become more detailed

Q193: A company reports basic earnings per share