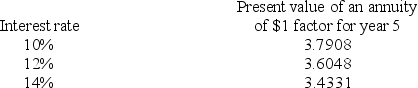

Tressor Company is considering a 5-year project. The company plans to invest $90,000 now and it forecasts cash flows for each year of $27,000. The company requires that investments yield a discount rate of at least 14%. Selected factors for a present value of an annuity of $1 for five years are shown below:  Calculate the internal rate of return to determine whether it should accept this project.

Calculate the internal rate of return to determine whether it should accept this project.

Definitions:

0.01

A numerical value representing one hundredth, often used in statistics, measurements, and as a decimal in mathematical calculations.

Product

The result of multiplying two numbers together.

Dividing

The act of separating or partitioning something into two or more parts or sections.

Cups

Commonly used household items that serve as containers for drinking liquids.

Q22: Ash Company reported sales of $400,000 for

Q47: The primary purpose of the statement of

Q60: A company has just received a special,

Q114: Citi Company is preparing the company's statement

Q116: When preparing the operating activities section of

Q125: When preparing the operating activities section of

Q137: Refer to the following selected financial

Q149: Of the following, which one affects cash

Q162: Which of the following statements is not

Q219: A flexible budget may be prepared:<br>A) Before