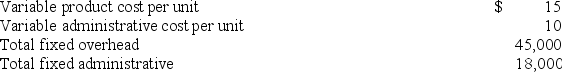

Galla Inc. needs to determine a price for a new product. Galla desires a 25% markup on the total cost of the product. Galla expects to sell 5,000 units. Additional information is as follows:  Using the total cost method what price should Galla charge?

Using the total cost method what price should Galla charge?

Definitions:

Single-Step Income Statement

A simplified income statement that summarizes revenues and expenses in a single step, without categorizing them.

Sales Revenue

Financial income derived from transactions involving the sale of products or provision of services over an interval of time.

Gross Profit Rate

The ratio of gross profit to total sales, indicating the percentage of revenue that exceeds the cost of goods sold.

Net Income

The amount of earnings left after all expenses, including taxes and operating costs, have been subtracted from total revenue; a measure of company profitability.

Q4: Another name for relevant cost is unavoidable

Q20: The internal rate of return method of

Q66: Northeast Inc. is preparing the company's statement

Q85: In the analysis of variances, management commonly

Q97: A company's transactions with its creditors to

Q143: The most useful allocation basis for the

Q144: What is the purpose of a departmental

Q168: The type of department that generates revenues

Q174: Static budget is another name for:<br>A) Standard

Q188: Differential Chemical produced 10,000 gallons of Preon