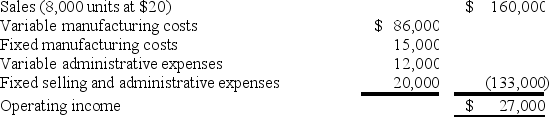

Markson Company had the following results of operations for the past year:  A foreign company offers to buy 2,000 units at $14 per unit. In addition to variable manufacturing and administrative costs, selling these units would increase fixed overhead by $1,600 for the purchase of special tools. Markson's annual productive capacity is 12,000 units. If Markson accepts this additional business, its profits will:

A foreign company offers to buy 2,000 units at $14 per unit. In addition to variable manufacturing and administrative costs, selling these units would increase fixed overhead by $1,600 for the purchase of special tools. Markson's annual productive capacity is 12,000 units. If Markson accepts this additional business, its profits will:

Definitions:

Depreciation Expense

The allocation of the cost of a tangible asset over its useful life, reflecting the decrease in value of the asset over time.

Straight-Line Method

A method of calculating depreciation or amortization by evenly spreading the cost over the useful life of the asset.

Gross Profit Rate

A financial metric that represents the percentage of revenue that exceeds the cost of goods sold.

Perpetual Inventory Method

A system of inventory management where updates are made continuously to account for additions to and subtractions from inventory, showing real-time inventory levels.

Q6: The accounting rate of return (ARR) is

Q81: Based on a predicted level of production

Q92: Dragoo Building Inc. has a crane with

Q97: Relevant costs are also known as _.

Q122: The accountant for Crusoe Company is preparing

Q127: The cash conversion cycle is calculated by

Q139: Logan Company can sell all of the

Q143: After-tax net income divided by the average

Q154: A purchase of land in exchange for

Q210: A variable or flexible budget is so