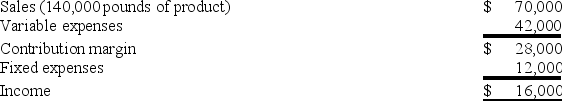

The Mixed Nuts Division of Yummy Snacks, Inc. had the following operating results last year:

Yummy expects identical operating results in the division this year. The Mixed Nuts Division has the ability to produce and sell 200,000 pounds of product annually. Assume that the Trail Mix Division of Yummy wants to purchase an additional 20,000 pounds of nuts from the Mixed Nuts Division. Mixed Nuts will be able to increase its profit by accepting any transfer price above:

Definitions:

Partners' Equity

The total value of capital contributed by partners and the accumulated profits of a partnership firm, minus any withdrawals.

Investment Error

Mistakes made in the process of investing capital, which can range from calculation errors to misunderstanding an investment's risks.

Capital Balance

The Capital Balance represents the amount of money that owners have invested in a business minus any withdrawals. It indicates the financial stake of the owners in the business.

Profits and Losses

Financial gains or deficits that a business experiences, typically shown in an income statement.

Q19: Markup percentage equals total costs divided by

Q62: Additional costs incurred if a company pursues

Q63: A plan that reports the units or

Q76: Briefly describe both the payback period method

Q101: Maxim manufactures a hamster food product called

Q131: A company's flexible budget for the range

Q139: The financial statement effects of the budgeting

Q166: During November, Glime Company allocated overhead to

Q182: The standard materials cost to produce 1

Q201: Bengal Co. provides the following unit sales