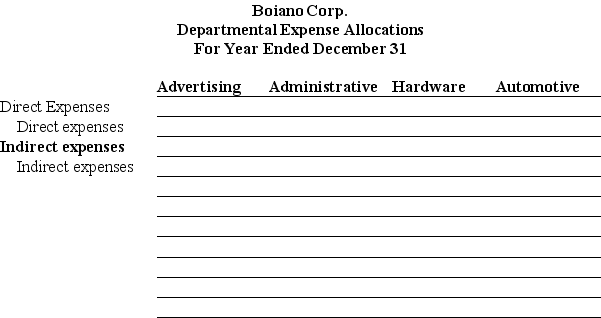

Boiano Corp. operates a retail store and has two service departments and two operating departments, Hardware and Automotive. During the current year, the departments had the following direct expenses and occupied the following amount of floor space.

The advertising department developed and aired 150 spots. Of these spots, 60 spots were for Hardware and 90 spots were for Automotive. The store sold $1,500,000 of merchandise during the year; $675,000 in Hardware and $825,000 in Automotive. Indirect expenses include rent, utilities, and insurance expense. Total indirect expenses of $220,000 are allocated to all departments. Prepare a departmental expense allocation spreadsheet for Boiano. The spreadsheet should assign (1) direct expenses to each of the four departments, (2) allocate the indirect expenses to each department on the basis of floor space occupied, (3) the advertising department's expenses to the two operating departments on the basis of ad spots placed promoting each department's products, (4) the administrative department's expenses based on the amount of sales. Complete the departmental expense allocation spreadsheet below. Provide supporting computations for the expense allocations below the spreadsheet.

Definitions:

Clogged Arteries

A condition caused by the buildup of plaque inside the blood vessels, leading to reduced blood flow and increased risk of cardiovascular diseases.

Asthma

A chronic respiratory condition characterized by episodes of airway constriction, leading to wheezing, coughing, and shortness of breath.

Expressing Anger

This term covers the various ways individuals may display or communicate feelings of anger, from verbal expressions to physical reactions.

Calm

A state of internal peace and tranquility, with an absence of mental stress or anxiety.

Q3: Advertising expense can be reasonably allocated to

Q13: Briefly describe the time value of money.

Q28: What is activity-based budgeting?

Q35: A company's flexible budget for 36,000 units

Q96: A(n) _ is a department that generates

Q121: Management by exception means that managers focus

Q126: Zhang Industries sells a product for $700

Q162: The following information describes production activities of

Q178: Expenses that are not easily traced to

Q209: Presented below are terms preceded by letters