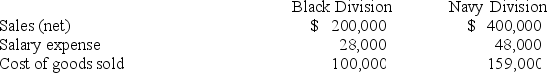

Marian Corporation has two separate divisions that operate as profit centers. The following information is available for the most recent year:  The Black Division occupies 20,000 square feet in the plant. The Navy Division occupies 30,000 square feet. Rent is an indirect expense and is allocated based on square footage. Rent expense for the year was $50,000. Compute departmental income for the Black and Navy Divisions, respectively.

The Black Division occupies 20,000 square feet in the plant. The Navy Division occupies 30,000 square feet. Rent is an indirect expense and is allocated based on square footage. Rent expense for the year was $50,000. Compute departmental income for the Black and Navy Divisions, respectively.

Definitions:

Discount Rate

An interest rate used by central banks to lend money to commercial banks, intended to influence the broader economy.

Initial Investment

The initial amount of money or capital put into an investment project or venture.

Operating Cash Flow

The amount of money generated by a company's regular business operations, indicating its ability to pay bills, repay debts, and reinvest in its business.

Depreciation

The process of allocating the cost of a tangible asset over its useful life, reflecting the decline in value over time.

Q1: Riemer, Inc. has four departments. Information about

Q26: For each of the capital budgeting methods

Q55: The Dark Chocolate Division of Yummy

Q61: Jarrett Department Store operates three departments (A,

Q92: Dragoo Building Inc. has a crane with

Q122: A firm produces and sells two products,

Q135: In preparing financial budgets:<br>A) The budgeted balance

Q157: A firm produces and sells two products,

Q174: In the preparation of departmental income statements,

Q209: The budgeted balance sheet is prepared primarily