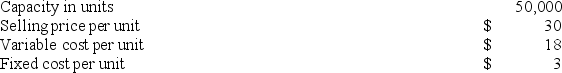

Division A produces a part with the following characteristics:  Division B, another division in the company, would like to buy this part from Division A. Division B is presently purchasing the part from an outside source at $28 per unit. If Division A sells to Division B, $1 in variable costs can be avoided. Suppose Division A is currently operating at capacity and can sell all of the units it produces on the outside market for its usual selling price. From the point of view of Division A, any sales to Division B should be priced no lower than:

Division B, another division in the company, would like to buy this part from Division A. Division B is presently purchasing the part from an outside source at $28 per unit. If Division A sells to Division B, $1 in variable costs can be avoided. Suppose Division A is currently operating at capacity and can sell all of the units it produces on the outside market for its usual selling price. From the point of view of Division A, any sales to Division B should be priced no lower than:

Definitions:

Debt-Equity Ratio

The ratio demonstrating the proportionate role of debt and equity in a company's asset financing scheme.

Payout Ratio

The percentage of a company's earnings that is paid out to shareholders in the form of dividends.

Internal Growth Rate

The internal growth rate is a measure of an organization's ability to increase its sales and profit without issuing more stock or incurring new debt.

Full Capacity

A term referring to the maximum level of production or output that a facility can achieve under normal operating conditions.

Q16: Decentralization refers to companies that have multiple

Q48: Claremont Company sells refurbished copiers. During the

Q71: Ultimo Co. operates three production departments as

Q127: A sporting goods manufacturer budgets production of

Q137: Joint costs can be allocated either using

Q137: A corporation reported average total assets in

Q140: In a firm that manufactures clothing, the

Q152: For projects financed from borrowed funds, the

Q166: During November, Glime Company allocated overhead to

Q171: A cost variance is the difference between