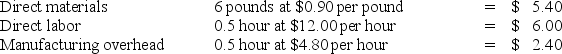

A company uses the following standard costs to produce a single unit of output.  During the latest month, the company purchased and used 58,000 pounds of direct materials at a price of $1.00 per pound to produce 10,000 units of output. Direct labor costs for the month totaled $56,350 based on 4,900 direct labor hours worked. Variable manufacturing overhead costs incurred totaled $15,000 and fixed manufacturing overhead incurred was $10,400. Based on this information, the total direct labor cost variance for the month was:

During the latest month, the company purchased and used 58,000 pounds of direct materials at a price of $1.00 per pound to produce 10,000 units of output. Direct labor costs for the month totaled $56,350 based on 4,900 direct labor hours worked. Variable manufacturing overhead costs incurred totaled $15,000 and fixed manufacturing overhead incurred was $10,400. Based on this information, the total direct labor cost variance for the month was:

Definitions:

Overapplied Manufacturing Overhead

A scenario in which the assigned costs for manufacturing overhead are greater than the overhead expenses actually encountered.

Cost of Goods Sold

This is the direct costs attributable to the production of the goods sold in a company, including both materials and labor costs.

Adjusted Cost

The cost that has been modified for adjustments like discounts, returns, or additional charges to reflect the true cost of purchase or production.

Cost of Goods Sold

Costs directly linked to the manufacturing of goods a business sells, covering both the cost of materials and labor.

Q2: Rent and maintenance expenses would most likely

Q15: An example of a controllable cost is

Q25: The sales budget for Modesto Corp. shows

Q42: Vision Tester, Inc., a manufacturer of optical

Q54: _ are costs incurred to produce or

Q63: The difference between the actual sales and

Q84: A budget is best described as:<br>A) A

Q85: The budget process rarely coincides with the

Q119: Fletcher Company collected the following data regarding

Q132: A(n) _ requires a future outlay of