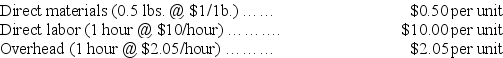

Beluga Corp. has developed standard costs based on a predicted operating level of 352,000 units of production, which is 80% of capacity. Variable overhead is $281,600 at this level of activity, or $0.80 per unit. Fixed overhead is $440,000. The standard costs per unit are:

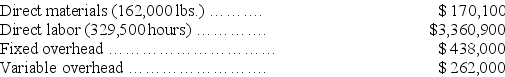

Beluga actually produced 330,000 units at 75% of capacity and actual costs for the period were:

Beluga actually produced 330,000 units at 75% of capacity and actual costs for the period were:

Calculate the following variances and indicate whether each variance is favorable or unfavorable:

Calculate the following variances and indicate whether each variance is favorable or unfavorable:

(1) Direct labor efficiency variance: $________

(2) Direct materials price variance: $________

(3) Controllable overhead variance: $________

Definitions:

Margin

Net operating income divided by sales.

Turnover

Sales divided by average operating assets.

Manufacturing Cycle Efficiency

A metric that measures the efficiency of the manufacturing process by comparing the value-added production time to the total production time.

Non-value-added Time

Time spent in the production process that does not contribute to the end product's value or quality, often targeted for reduction in lean manufacturing practices.

Q9: A capital expenditures budget is prepared before

Q17: Grant Co. uses the following standard to

Q59: An _ standard is based on 100%

Q60: Addams, Inc., is preparing its master budget

Q66: When using a standard cost accounting system,

Q75: Given the following data, calculate product cost

Q113: _ costing is the only acceptable basis

Q166: Two investment centers at Marshman Corporation have

Q185: The following is a partially completed lower

Q192: Parallel Enterprises has collected the following data