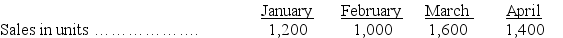

Hammerly Corporation is preparing its master budget for the quarter ending March 31. It sells a single product for $25 a unit. Budgeted sales are 40% cash and 60% on credit. All credit sales are collected in the month following the sales. Budgeted unit sales for the next four months follow:

At December 31, the balance in accounts receivable is $10,000, which represents the uncollected portion of December sales. The company desires merchandise inventory equal to 30% of the next month's sales in units. The December 31 balance of merchandise inventory is 340 units, and inventory cost is $10 per unit. 40% of purchases are paid in the month of purchase and 60% are paid in the following month. At December 31, the balance of Accounts Payable is $8,000, which represents the unpaid portion of December's purchases.

Operating expenses are paid in the month incurred and consist of:

· Sales commissions (10% of sales)

· Freight (2% of sales)

· Office salaries ($2,400 per month)

· Rent ($4,800 per month)

Depreciation expense is $4,000 per month. The income tax rate is 40%, and income taxes will be paid on April 1. A minimum cash balance of $10,000 is required, and the cash balance at December 31 is $10,200. Loans are obtained at the end of a month in which a cash shortage occurs. Interest is 1% per month, based on the beginning of the month loan balance, and must be paid each month (The interest payment is rounded to the nearest whole dollar). If the ending cash balance exceeds the minimum, the excess will be applied to repaying any outstanding loan balance. At December 31, the loan balance is $0.

Prepare a master budget (round all dollar amounts to the nearest whole dollar) for each of the months of January, February, and March that includes the:

· Sales budget

· Schedule of cash receipts

· Merchandise purchases budget

· Schedule of cash payments for merchandise purchases

· Schedule of cash payments for selling and administrative expenses (combined)

· Cash budget, including information on the loan balance

· Budgeted income statement for the quarter

Definitions:

Ultraviolet Radiation

Electromagnetic radiation with a wavelength shorter than that of visible light but longer than X-rays, capable of producing chemical reactions and damaging living tissues.

Greenhouse Gas Emitter

An entity, such as a factory, vehicle, or biological process, that releases greenhouse gases into the atmosphere, contributing to global warming.

Lifestyle Choices

Decisions made by individuals regarding their daily habits and behaviors, including diet, exercise, and other activities that impact health and well-being.

Gene Composition

The arrangement and types of genes present within an organism's genome.

Q3: The departmental overhead rate method allows each

Q32: Variable budget is another name for:<br>A) Cash

Q50: Standard costs are preset costs for delivering

Q70: The amount by which a department's sales

Q84: A flexible budget performance report compares the

Q90: Which of the following costs are most

Q108: Quaker Corporation sold 6,600 units of its

Q128: Fletcher Company collected the following data regarding

Q129: Describe how a cost-volume-profit analysis would be

Q189: Products are the first stage cost objects