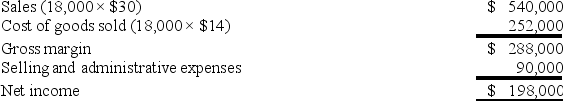

Tim's Tools, a manufacturer of cordless drills, began operations this year. During this year, the company produced 20,000 units and sold 18,000 units. At year-end, the company reported the following income statement using absorption costing:  Production costs per unit total $14, which consists of $12.90 in variable production costs and $1.10 in fixed production costs (based on the 20,000 units produced) . 60% of total selling and administrative expenses are variable. Compute net income under variable costing.

Production costs per unit total $14, which consists of $12.90 in variable production costs and $1.10 in fixed production costs (based on the 20,000 units produced) . 60% of total selling and administrative expenses are variable. Compute net income under variable costing.

Definitions:

Demand-Side Factors

Factors affecting the quantity of a product or service demanded at a given price, including income levels, tastes, and preferences of consumers.

Finite Natural Resources

Natural resources that exist in limited quantities and are not renewable within a human lifespan, such as fossil fuels and minerals.

Per Capita Consumption

The average amount of goods or services consumed per person in a given population or area.

Birthrates

The number of live births per thousand of population per year, indicating the rate at which a population is growing.

Q8: Budgets are long-term financial plans that generally

Q46: A break-even point can be calculated either

Q137: Data concerning volume-related measures are readily available

Q149: What is the reason for pooling costs?<br>A)

Q158: The following data relates to Patterson Company's

Q158: Which of the following statements is true

Q182: Materials Corporation sold 12,000 units of its

Q187: Assume a company had the following production

Q189: Describe at least five benefits of budgeting.

Q193: A firm expects to sell 25,000 units