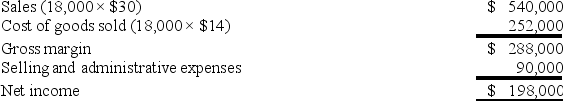

Tim's Tools, a manufacturer of cordless drills, began operations this year. During this year, the company produced 20,000 units and sold 18,000 units. At year-end, the company reported the following income statement using absorption costing:  Production costs per unit total $14, which consists of $12.90 in variable production costs and $1.10 in fixed production costs (based on the 20,000 units produced) . 60% of total selling and administrative expenses are variable. Compute net income under variable costing.

Production costs per unit total $14, which consists of $12.90 in variable production costs and $1.10 in fixed production costs (based on the 20,000 units produced) . 60% of total selling and administrative expenses are variable. Compute net income under variable costing.

Definitions:

Sympathetic Nervous System

Part of the autonomic nervous system that prepares the body for action and stress, triggering the "fight or flight" response.

Digestion

The process by which the body breaks down food into smaller components, ultimately to be absorbed into the bloodstream for nutrition.

Pupil Dilation

The expansion of the pupil, influenced by light exposure, emotional states, and arousal levels.

Nervous System

The complex network of nerves and cells that transmits signals between different parts of the body.

Q2: Grason Corporation is preparing a budgeted balance

Q44: A firm sells two products, Regular and

Q95: A company's flexible budget for 48,000 units

Q117: Operating budgets include all the following except

Q129: Blatt Company, a manufacturer of slippers,

Q151: A job was budgeted to require 3

Q168: The cost to heat a manufacturing facility

Q169: Triton Industries reports the following information

Q201: Assuming fixed costs remain constant, and a

Q219: Direct labor, direct materials, and manufacturing overhead