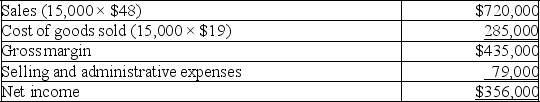

Anchovy, Inc., a producer of frozen pizzas, began operations this year. During this year, the company produced 16,000 cases of pizza and sold 15,000. At year-end, the company reported the following income statement using absorption costing:

Production costs per case total $19, which consists of $15.50 in variable production costs and $3.50 in fixed production costs (based on the 16,000 units produced). Eight percent of total selling and administrative expenses are variable. Compute net income under variable costing.

Production costs per case total $19, which consists of $15.50 in variable production costs and $3.50 in fixed production costs (based on the 16,000 units produced). Eight percent of total selling and administrative expenses are variable. Compute net income under variable costing.

Definitions:

Manufacturing Processes

The series of steps involved in the production of goods, from raw materials to finished products.

Plantwide Allocation Base

A single criterion, often direct labor hours or machine hours, used to allocate the total overhead of a plant to various products or cost objects.

Budgeted Units

The quantity of products or services that are planned to be sold or produced over a specific period, as per the budget.

Plantwide Factory Overhead Rate

A single overhead absorption rate used throughout a manufacturing plant, applied to all cost units irrespective of the department where they were produced.

Q11: Ballentine Company expects sales for June, July,

Q24: Hatter, Inc. allocates fixed overhead at a

Q85: Cleveland Choppers manufactures two types of motorcycles,

Q100: Compute Aztec's departmental overhead rate for the

Q105: In a company that employs continuous budgeting

Q106: The use of absorption costing can result

Q141: Cahuilla Corporation predicts the following sales in

Q177: Overhead costs cannot be _ in the

Q178: Cost-volume-profit analysis cannot be used when a

Q217: Clevenger Co. planned to produce and sell