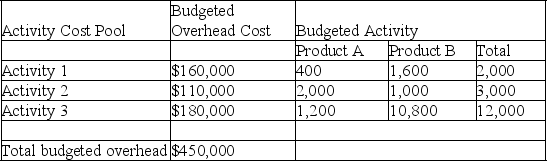

A company has two products: A and B. It uses activity-based costing and has prepared the following analysis showing budgeted costs and activities. Use this information to compute (a) the company's overhead rates for each of the three activities and (b) the amount of overhead allocated to Product A.

Definitions:

Current Asset

Assets that are expected to be converted into cash, sold, or consumed within one year or within the normal operating cycle of a business.

Periodic Inventory System

An accounting method where inventory values and cost of goods sold are determined at the end of an accounting period.

Merchandise Inventory

refers to the goods available for sale to customers in the retail and wholesale industries.

Cost of Merchandise Sold

The total expense incurred by a business to sell goods over a period, including the cost of acquiring or manufacturing those goods.

Q51: Process costing systems use a single Work

Q77: Williams Company computed its cost per equivalent

Q97: The Factory Overhead account will have a

Q134: The process cost summary presents calculations of

Q144: Refer to the following information about the

Q148: Adams Manufacturing allocates overhead to production on

Q155: A company identified the following partial list

Q157: Proctor Company has fixed costs of $315,000

Q159: A company uses activity-based costing to determine

Q212: The major advantages of using a single