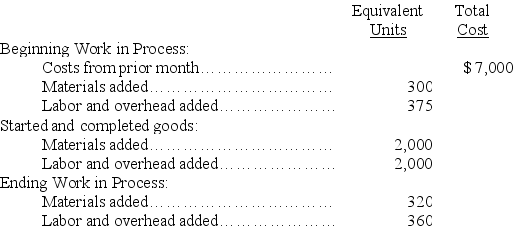

Refer to the following information about the Shaping Department of the Minnesota Factory for the month of August. Minnesota Factory uses the FIFO method of inventory costing.

The cost per equivalent unit of materials is $10.00, and the cost per equivalent unit of labor and overhead is $22.00. Compute the cost that should be assigned to the ending Work in Process inventory for August.

The cost per equivalent unit of materials is $10.00, and the cost per equivalent unit of labor and overhead is $22.00. Compute the cost that should be assigned to the ending Work in Process inventory for August.

Definitions:

Exchange Gain/Loss

The gain or loss resulting from the fluctuation in exchange rates affecting the value of foreign currency transactions.

Functional Currency

The primary currency used by a business or organization for accounting purposes, reflecting the economic context of its operations.

Functional Currency

The primary currency used by a business or entity in its financial operations and reporting.

Current Monetary Assets

Assets held by a company that are in the form of cash or can be easily converted into cash within a short period, typically one year.

Q3: The departmental overhead rate method allows each

Q21: Crinkle Cut Clothes Company manufactures two

Q64: Portside Watercraft uses a job order costing

Q66: Juarez Builders incurred $285,000 of labor costs

Q91: _, or customized production, produces products in

Q135: ABC is significantly less costly to implement

Q173: The _ is the sales level at

Q188: Tarnish Industries uses departmental overhead rates and

Q220: The following information is available for a

Q220: Dazzle, Inc. produces beads for jewelry making