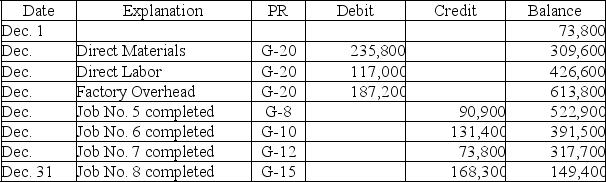

A company uses a job order costing system and applies overhead on the basis of direct labor cost. A summary of the company's Work in Process Inventory account for December appears below.

Work In Process

Fill in the blanks for the following:

Fill in the blanks for the following:

(1) The total cost of the direct materials, direct labor, and factory overhead for jobs still in progress is $________.

(2) The company's overhead application rate is ________%

(3) Job No. 6 had $26,550 of direct labor cost. Therefore, the job must have had $________ of direct materials cost.

(4) Job No. 8 had $73,998 of direct materials cost. Therefore, the job must have had $________ of factory overhead cost.

Definitions:

Accounting Principles

Fundamental guidelines or rules that underpin the process of accounting, including concepts like the matching principle, revenue recognition, and historical cost.

Short-term Creditors

Lenders or entities from whom a company has borrowed money or resources that are to be repaid within one year.

Liquidity

The ability of an asset to be quickly converted into cash or an entity's capacity to meet its immediate and short-term obligations.

Unusual Items

Non-recurring or uncommon transactions that are outside the usual business operation, which might distort the financial statements if not separately disclosed.

Q5: The higher a company's debt ratio, the

Q40: Cost accounting information is helpful to management

Q69: If the predetermined overhead allocation rate is

Q87: The detail of individual revenue and expense

Q108: Which of the following is the best

Q132: Adams Manufacturing allocates overhead to production on

Q141: Minstrel Manufacturing uses a job order costing

Q165: A credit:<br>A) Always decreases an account.<br>B) Is

Q189: Which of the following should not be

Q239: A law firm collected $1,800 on account