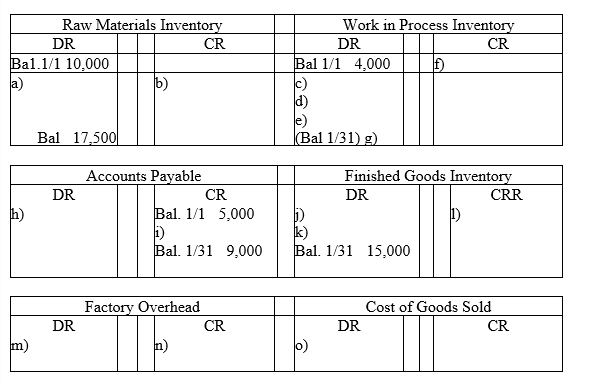

MOB Corp. applies overhead on the basis of direct labor costs. Its bookkeeper accidentally deleted most of the journal entries that had been recorded for January. A printout of the general ledger (in T-account form) showed the following:

A review of the prior year's financial statements, the current year's budget, and January's source documents produced the following information:

(1) Accounts Payable is used for raw material purchases only. January purchases were $49,000.

(2) Factory overhead costs for January were $17,000 none of which is indirect materials.

(3) The January 1 balance for finished goods inventory was $10,000.

(4) There was a single job in process at January 31 with a cost of $2,000 for direct materials and $1,500 for direct labor.

(5) Total cost of goods manufactured for January was $90,000.

(6) All direct laborers earn the same rate ($13/hour). During January, 2,500 direct labor hours were worked.

(7) The predetermined overhead rate is based on direct labor costs. Budgeted (expected) overhead for the year is $195,000 and budgeted (expected) direct labor is $390,000.

Fill in the missing amounts a) through o) above in the T-accounts above.

Definitions:

Motion-Sensing Game Console

A gaming device that detects players' physical movements as input for interactive gameplay.

MPEG-4 Codec

A technology for compression of audio and video files, enabling efficient streaming and storage of multimedia content.

Digital Video

A type of video recorded, processed, or stored in a digital format, using binary code to represent visual images.

Online Streaming Services

Platforms that deliver content, such as music or video, over the Internet in real-time without the need for downloading.

Q14: A double-entry accounting system is an accounting

Q20: Cost accounting systems accumulate production costs and

Q90: Explain how a service firm, such as

Q91: Explain cost flows for the departmental overhead

Q107: The _ overhead rate method uses multiple

Q110: Richards Corporation uses the weighted-average method of

Q119: All of the following statements accurately describe

Q120: The record of all accounts and their

Q128: Adriana Graphic Design receives $1,500 from

Q194: What are the three groups of accounts