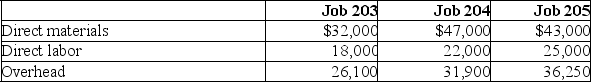

At the end of June, job cost sheets for Kennedy Manufacturing show the following total costs accumulated on three custom jobs:

Job 203 was started in production in May and the following costs were assigned to it in May: direct materials, $12,000; direct labor, $6,000; and overhead $8,700. Jobs 204 and 205 are started in June. Overhead cost is applied with a predetermined rate based on direct labor cost. Jobs 203 and 204 are finished in June, and Job 205 will be finished in July. No raw materials are used indirectly in June. Using this information, answer the following questions assuming the company's predetermined overhead rate did not change.

a. What is the total cost of direct materials requisitioned in June for the three jobs?

b. What is the total direct labor cost incurred during June for the three jobs?

c. What predetermined overhead rate is used during June?

d. How much total cost is transferred to finished goods during June?

Definitions:

Business Model

A framework outlining how a company creates, delivers, and captures value within its operational context.

Evidence

Information or facts that are used to support the validity of a statement, theory, or finding.

Infrastructure

The resources (people, technology, products, suppliers, partners, facilities, cash, etc.) that an entrepreneur must have in order to deliver the Customer Value Proposition (CVP).

Financial Viability

Defines the revenue and cost structures a business needs to meet its operating expenses and financial obligations.

Q38: In nearly all job order cost systems,

Q45: Cosi Company uses a job order costing

Q60: Identify the accounts that would normally have

Q61: A company's beginning Work in Process inventory

Q115: Richards Corporation uses the FIFO method of

Q141: Indicate on which financial statement each of

Q145: Minstrel Manufacturing uses a job order costing

Q202: Explain debits and credits and their role

Q209: Superior Products Manufacturing identified the following data

Q216: Chung Corporation uses a job order