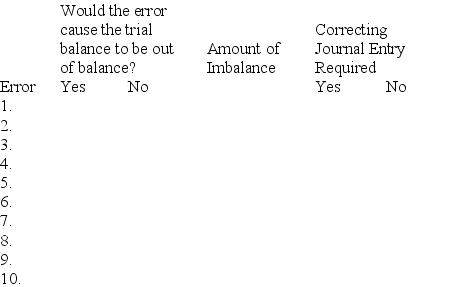

At year-end, Henry Laundry Service noted the following errors in its trial balance:

1. It understated the total debits to the Cash account by $500 when computing the account balance.

2. A credit sale for $311 was recorded as a credit to the revenue account, but the offsetting debit was not posted.

3. A cash payment to a creditor for $2,600 was never recorded.

4. The $680 balance of the Prepaid Insurance account was listed in the credit column of the trial balance.

5. A $24,900 van purchase was recorded as a $24,090 debit to Equipment and a $24,090 credit to Notes Payable.

6. A purchase of office supplies for $150 was recorded as a debit to Office Equipment. The offsetting credit entry was correct.

7. An additional investment of $4,000 by stockholders was recorded as a debit to Common Stock and as a credit to Cash.

8. The cash payment of the $510 utility bill for December was recorded (but not paid) twice.

9. The revenue account balance of $79,817 was listed on the trial balance as $97,817.

10. A $1,000 cash dividend was recorded as a $100 debit to Dividends and $100 credit to cash.

Using the form below, indicate whether each error would cause the trial balance to be out of balance, the amount of any imbalance, and whether a correcting journal entry is required.

Definitions:

Free Cash Flow Valuation Approach

A method of valuing a business by estimating the cash that can be generated after accounting for capital outlays necessary to maintain or expand the asset base.

Present Value

A calculation that determines the current worth of a future sum of money or stream of cash flows given a specified rate of return.

Distributable Cash Flows

The amount of cash flow available to be distributed to security holders, often used in the context of REITs and master limited partnerships.

Cash Flow Assessment

The evaluation of how well a company generates cash to pay its debt obligations and fund its operating expenses.

Q12: When the data about Target's customers was

Q38: Define artificial intelligence system and list the

Q38: Expenditures incurred in the process of converting

Q40: If you wish to have a visual

Q53: _ means that managers and employees understand

Q65: There are bots that can sign up

Q99: An important managerial accounting report is the

Q130: The _ is a collection of all

Q141: Indicate on which financial statement each of

Q186: A company's job order costing system applies