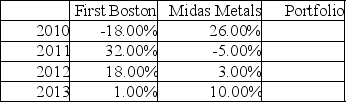

Returns on the stock of First Boston and Midas Metals for the years 2010-2013 are shown below.

a. Compute the average annual return for each stock and a portfolio consisting of 50% First Boston and 50% Midas.

b. Compute the standard deviation for each stock and the portfolio.

c. Are the stocks positively or negatively correlated and what is the effect on risk?

Definitions:

Societal Influences

The effects of societal norms, values, and culture on an individual's behavior and decisions.

Environmental Influences

External factors that affect an individual's behavior, decisions, and lifestyle.

Performance Appraisals

The systematic evaluation of employees' job performance and productivity to provide feedback, guide future performance, and inform decisions on promotions, compensations, and development.

Recruitment Techniques

Strategies and methods used by organizations to identify, attract, and select potential employees.

Q4: The stock of Plomb Co. falls sharply

Q10: Most brokerage firms will invest surplus cash,

Q29: The price an individual investor will pay

Q42: Assume that the S&P 500 composite stock

Q49: Because a futures contract deals with very

Q49: Which of the following is a contrary

Q54: SEC regulations strictly prohibit trading outside the

Q70: Each of the following investments produces the

Q78: The investment value for a publicly traded

Q120: Positive cash flow from investing activities is