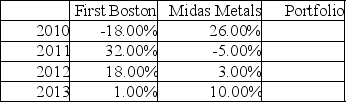

Returns on the stock of First Boston and Midas Metals for the years 2010-2013 are shown below.

a. Compute the average annual return for each stock and a portfolio consisting of 50% First Boston and 50% Midas.

b. Compute the standard deviation for each stock and the portfolio.

c. Are the stocks positively or negatively correlated and what is the effect on risk?

Definitions:

Individual Income Tax Returns

Forms submitted by individuals to report income, calculate taxes owed, and determine eligibility for tax refunds.

Corporate Profits Tax

A levy placed on the profit of a firm, with different rates used for varying levels of profit.

Individual Income Tax Rate

The percentage at which an individual's earned income is taxed by the government, which can vary depending on the level of income and other factors.

Corporate Sector

The segment of the economy that is comprised of companies or corporations and is distinguished from the public sector and private individuals.

Q2: The Internet provides<br>I. educational sites for financial

Q6: Bond yields are<br>A) quoted as the average

Q16: The intrinsic value of a security is

Q37: Rising corporate profits and are likely to

Q38: Which of the following variables affect the

Q53: Name at least three economic variables that

Q74: A market where securities are are bought

Q84: Reinvested dividends<br>A) are taxed when the shares

Q93: An investor should buy a stock only

Q113: In the short term, stock prices tend