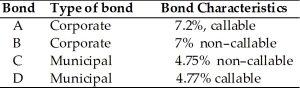

Martin is trying to decide which one of the following bonds he should purchase. All the bonds have the same maturity date and all have approximately the same level of risk. The general level of interest rates is declining. Martin is in the 33 percent federal income tax bracket and the 6 percent state income tax bracket. The municipal bonds are from his home state.  Which bond should Martin purchase if he wishes to hold it for the long term?

Which bond should Martin purchase if he wishes to hold it for the long term?

Definitions:

Tax Rate

The percentage at which an individual or corporation is taxed, which can vary based on income levels, jurisdictions, and specific types of taxes.

Treasury Stock Approach

A method used in calculating diluted earnings per share, considering the potential impact of convertible securities as if they were converted into common stock and then reacquired by the company.

Outstanding Voting Stock

The shares of stock that are currently owned by shareholders, including restricted shares, that have voting rights in a corporation.

Consolidated Stockholders' Equity

The total amount of equity attributed to owners of a parent company, after adding the equity of all subsidiaries and eliminating inter-company transactions.

Q7: The Krebs cycle _<br>A) produces carbohydrates in

Q52: Which of the following statements are correct

Q56: Which one of the following statements, A-D,

Q56: An electrochemical cell has both a silver

Q64: Market segmentation theory explains the typical upward

Q64: Bill owns 200 shares of EG stock.

Q82: Strontium-88 is the most abundant stable isotope.

Q115: The holding period return (HPR) of one's

Q116: Both realized and unrealized capital gains from

Q119: The higher a bond's Moody's or Standard