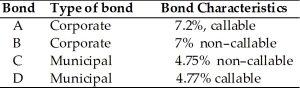

Martin is trying to decide which one of the following bonds he should purchase. All the bonds have the same maturity date and all have approximately the same level of risk. The general level of interest rates is declining. Martin is in the 33 percent federal income tax bracket and the 6 percent state income tax bracket. The municipal bonds are from his home state.  Which bond should Martin purchase if he wishes to hold it for the long term?

Which bond should Martin purchase if he wishes to hold it for the long term?

Definitions:

Optimal Stimulation

A psychological theory proposing that individuals seek an optimal level of arousal, with too little leading to boredom and too much resulting in stress.

Arousal Theory

The theory that optimal performance and psychological arousal are related in a way that differs as a function of the individual and the task.

Yerkes-Dodson Law

A theory suggesting there is an optimal level of arousal for performance, and that too little or too much arousal can negatively affect performance.

Arousal

A physiological and psychological state of being awake or reactive to stimuli, involving changes in heart rate, brain activity, and energy levels.

Q17: Fred and Martha are in their seventies

Q17: Why is iodine-131 used effectively to treat

Q41: Hydroxyapatite, which is a component of tooth

Q45: The <font face="symbol"></font>-helix and <font face="symbol"></font>-pleated sheet

Q57: The main purpose of a bond ladder

Q60: Reduction is the _<br>A) gain of electrons.<br>B)

Q83: Investors purchase shares in an open end

Q119: Which of the following methods might be

Q121: The various CMO tranches can have significantly

Q125: Which of the following statements about bond