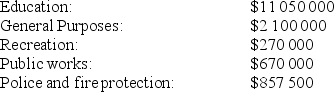

A town has an assessed residential property value of $350 000 000. The town council must meet the following expenditures:

a) Suppose 70% of the expenditures are charged against residential real estate. Calculate the total property taxes that must be raised.

a) Suppose 70% of the expenditures are charged against residential real estate. Calculate the total property taxes that must be raised.

b) What is the mill rate?

c) What is the property tax on a property assessed at $235 000?

Definitions:

Present Value

Today's worth of a forthcoming sum of money or series of cash payments, considering a designated rate of return.

Capital Investment Analysis

The process of evaluating and comparing potential investments or expenditures to determine their profitability and financial impact on the business.

Net Present Value Method

A method of evaluating the feasibility of projects or investments by calculating their net present value using a discount rate.

Average Rate of Return

A financial ratio that measures the profitability of an investment by dividing the average annual profit by the initial investment cost.

Q3: On his retirement, Louis received a lump

Q11: The PC financial is considering changing the

Q17: You start to save for a major

Q19: A free trade area is an association

Q49: One month from now, Shiva will make

Q73: The Saskatchewan Junior Achievers need to borrow

Q78: A 22-year mortgage is amortized by payments

Q85: Change the following percent into a common

Q94: Knowing that the education costs for her

Q100: Annette bought a vacation property for $22