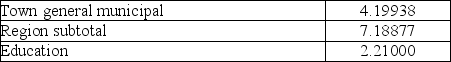

Paul is a homeowner in Whitby and his home value has been recently assessed by MPAC as $339 500. Paul's tax notice lists the following mill rates for various local services and capital developments. Calculate current year's total property tax.

Definitions:

Bad Debt Expense

A provision for accounts receivable that are considered unlikely to be collected.

Percentage of Credit Sales

An accounting method used to estimate bad debts expense by applying a fixed percentage to the total credit sales of a period.

Allowance Account

An accounting reserve established to adjust the carrying value of accounts receivable to their net realizable value, recognizing potential losses from uncollectible accounts.

Written Off Accounts

Accounts receivable that a company deems uncollectible and removes from its books.

Q18: Effective interviewers skip the breaking-the-ice phase of

Q20: Which of the following best represents the

Q24: Evaluate: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3016/.jpg" alt="Evaluate: " class="answers-bank-image

Q33: On March 1, Sam invested $90 000

Q42: Company culture is the distinctive, unwritten code

Q69: You make 4 semi-annual deposits starting at

Q74: What nominal rate of interest-compounded quarterly will

Q84: Entrepreneurs can use the Web to generate

Q102: Calculate the accumulated value after ten years

Q117: Only about one-third of the world's purchasing