Use the following information to prepare a cash budget for Knightsbridge Corporation for the month of June 2018.

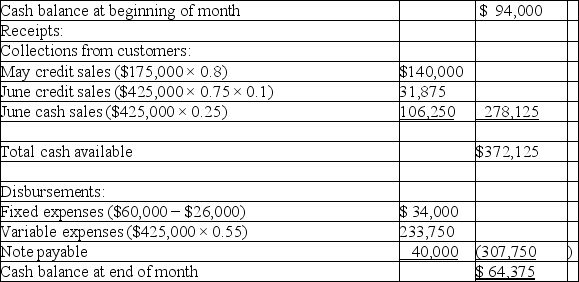

In May,30-day credit sales were $175,000;80% of this amount is estimated to be collectible in June.

June sales are estimated to be $425,000;cash sales are usually 25% of total sales.Only 10% of credit sales are collected in the month in which the sale is made.

Total fixed expenses are $60,000 per month,including $26,000 depreciation.Variable expenses are 55% of sales.All expenses requiring payment are paid in cash when incurred.

A $40,000 note payable must be paid on June 30.

As of May 31,the cash balance is $94,000.

Answer:

Difficulty: 3 Hard

Difficulty: 3 Hard

Topic: Preparing the Master Budget: An Illustration

Learning Objecti: 23-05 Prepare the budgets and supporting schedules included in a master budget.

Bloom's: Apply

AACSB: Analytical Thinking

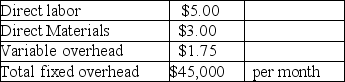

-Harding Company expected sales to be 50,000 units in February,45,000 in March,and 55,000 units in April.Each unit sells for $18.00 each.The following costs pertain to each unit:

Harding is considering an advertising campaign that will cost $15,000 per month from January through March;it is expected to increase sales by 8% a month.At the same time,Harding will reduce sales prices to $17.00 per unit while keeping costs steady.

Harding is considering an advertising campaign that will cost $15,000 per month from January through March;it is expected to increase sales by 8% a month.At the same time,Harding will reduce sales prices to $17.00 per unit while keeping costs steady.

Required:

(A. )What will operating income be in each of the three months before the advertising campaign?

(B. )If Harding goes ahead with the advertising campaign,how much would operating income increase or decrease each month? Would you advise them to go ahead with the campaign?

Definitions:

Federal Taxes

Federal taxes are financial charges imposed by a government on individuals, corporations, and other entities' income, property, or transactions to fund public services and obligations.

Regressive

A term referring to a tax system where the tax rate decreases as the amount subject to taxation increases, often disproportionately affecting lower-income individuals.

Value-Added Tax

A consumption tax placed on a product whenever value is added at a stage of production and at the point of retail sale.

United States

A country in North America consisting of 50 states, a federal district, five major self-governing territories, and various possessions.

Q2: Capital turnover is equal to sales divided

Q8: Which of the following would not be

Q11: The payback period can be determined by

Q12: Safeguarding customer information is a legal and

Q12: Service response logistics is the management and

Q47: Compute the net present value of this

Q50: Transfer prices and cash flow<br>Satellite Products,Inc.owns two

Q53: Capital investments are difficult,if not impossible,to reverse

Q54: The value chain usually starts with the

Q72: The Delux Company purchased and used 2,900