Incremental Analysis Information Regarding Current Operations of the Farrell Corporation Is Given

Incremental analysis

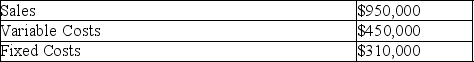

Information regarding current operations of the Farrell Corporation is given below:

The sales manager estimates that a proposed addition to Farrell's factory will increase sales by a maximum of $750,000.The company's accountants have determined that the proposed addition will add $320,000 to fixed costs each year.

The sales manager estimates that a proposed addition to Farrell's factory will increase sales by a maximum of $750,000.The company's accountants have determined that the proposed addition will add $320,000 to fixed costs each year.

(a)Explain why the existing $310,000 of fixed costs is a sunk cost while the $320,000 of fixed costs associated with the proposed addition is an out-of-pocket cost.

(b)Calculate by how much the proposed addition will either increase or reduce operating income.

Definitions:

Corporate Bonds

Debt securities issued by corporations to finance operations, typically offering fixed interest payments.

Convertible Bond

A type of bond that allows the bondholder to convert the bond into a predetermined number of shares of the issuing company, usually at certain times during its life.

Callable Bond

A kind of security that the issuer has the option to buy back prior to its maturity at a set price.

T-Bill Quote

The price or interest rate expressed for a Treasury bill; often quoted in terms of discount from face value.

Q12: A stock option is a right to

Q17: Accounting terminology<br>Listed below are seven technical accounting

Q19: Total manufacturing costs charged (debited)to Work in

Q26: What will be the monthly margin of

Q42: If direct labor and overhead costs totaled

Q69: Overhead volume variances indicate:<br>A)Efficient performance.<br>B)Inefficient performance.<br>C)Fluctuations in

Q70: A materials quantity variance is the standard

Q89: The expected rate of return on average

Q100: An overhead application rate is a device

Q101: As volume increases,per unit fixed costs stay