Accounting Terminology Listed Below Are Eight Technical Accounting Terms Introduced or Emphasized

Accounting terminology

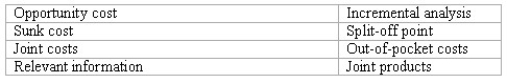

Listed below are eight technical accounting terms introduced or emphasized in this chapter:  Each of the following statements may (or may not)describe one of these technical terms.In the space provided beside each statement,indicate the accounting term described,or answer "None" if the statement does not correctly describe any of the terms.

Each of the following statements may (or may not)describe one of these technical terms.In the space provided beside each statement,indicate the accounting term described,or answer "None" if the statement does not correctly describe any of the terms.

________ (a)Data pertaining to future time periods that may vary among alternative courses of action.

________ (b)The point at which manufacturing costs are split between finished goods inventory and work in progress.

________ (c)The benefit foregone by pursuing one course of action over another.

________ (d)Products that emerge from common materials and shared production processes.

________ (e)A cost incurred in the past that will not change as a result of future actions.

________ (f)Costs yet to be incurred which are expected to vary under different courses of action.

________ (g)The examination of differences between future costs and revenue under varying courses of action.

Definitions:

Appellate Courts

Courts responsible for hearing appeals against legal decisions made by lower courts, reviewing cases for errors in application of the law.

Trial Courts

Courts of original jurisdiction where cases are tried, evidence is presented, and judgments are made, subject to appeal.

Legislative Process

The legislative process encompasses the steps through which proposed laws (bills) are debated, amended, and voted on in a legislative body before becoming official statutes.

Marginal Tax Rate

The rate at which the last dollar of a taxpayer's income is taxed, indicating the percentage of tax applied to their highest dollar of income.

Q20: By choosing to go into business for

Q33: Capital budgeting<br>Golden Flights,Inc.is considering buying some specialized

Q35: A responsibility income statement shows the revenue

Q38: The following information is for the Choplin

Q40: Non-value-added activities do not directly increase the

Q50: Management accounting encompasses the design and use

Q50: Transfer prices and cash flow<br>Satellite Products,Inc.owns two

Q62: A segment of a master budget relating

Q87: The total amount of inventory to be

Q89: Sunk costs have already been incurred and